Simple. Flexible. Efficient.

We have created a platform that truly seeks to help advisers serve their clients more efficiently and more effectively. PlatformplusWRAP creates opportunities to achieve new efficiencies in super and investment management.

Clear client benefits

Unique practice efficiencies

Full-featured platform functionality

Our platform helps advisers and clients build investment and super solutions that support the implementation of clients’ goals and investment strategies.

With access to a wide range of investment options, including a robust selection of environment, social, and governance (ESG) investment options, the platform supports a diverse range of investment preferences.

The platform also offers:

LEARN MORE ABOUT SUPER

LEARN MORE ABOUT INVESTMENTS

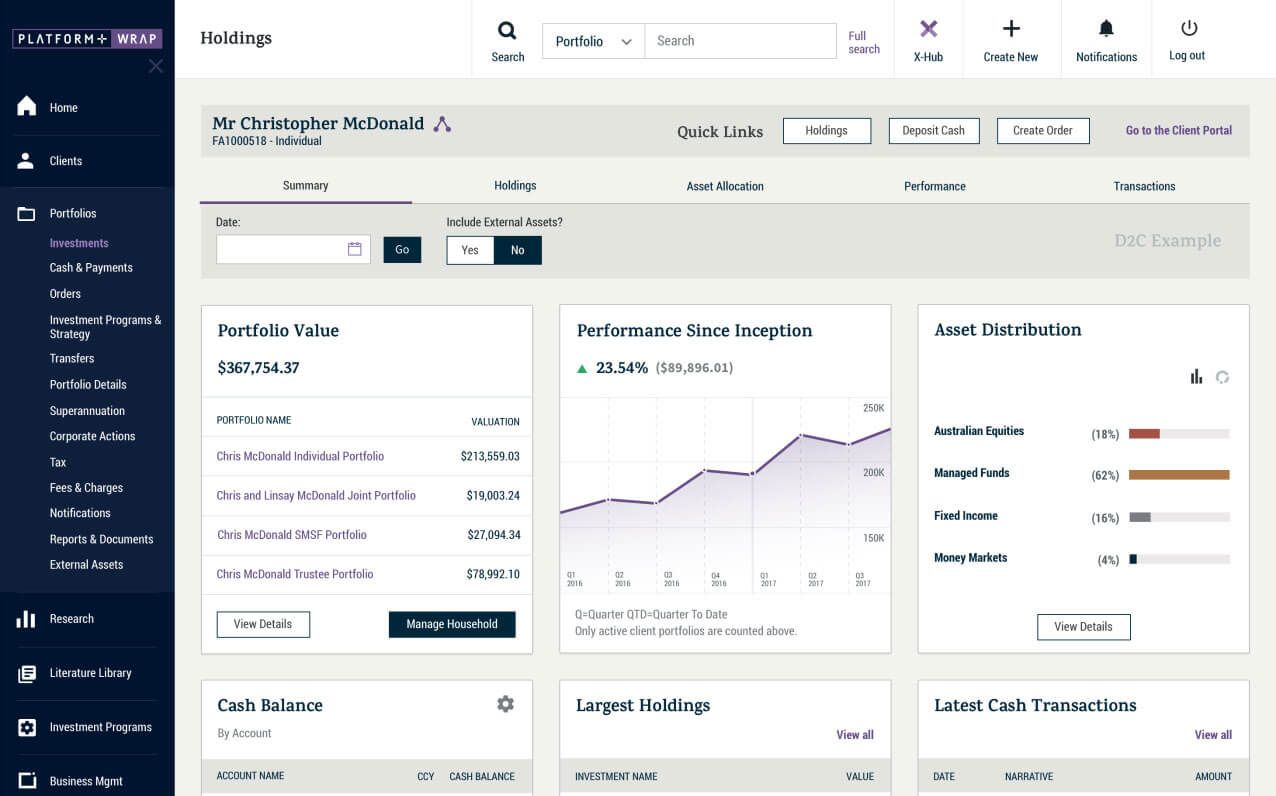

All you need to know about your investments is readily accessible via your Client Portal. With its intuitive interface, you can quickly and easily manage your investments and view your performance.

You can also use the Client Portal to collaborate with your adviser and facilitate your goal, advice and performance conversations.

Your adviser will be there to guide you through the setup process and to assist you with any questions. You also have access to our Australian-based Client Support Centre and 24/7 access to our online resources and help guides.

Your adviser is also supported by our Australian-based Platformplus Support Team ensuring that both clients and their advisers have assistance when they need it most.

Our platform is built on making investment implementation and management easier for you and your adviser.