Supporting your unique retirement strategies.

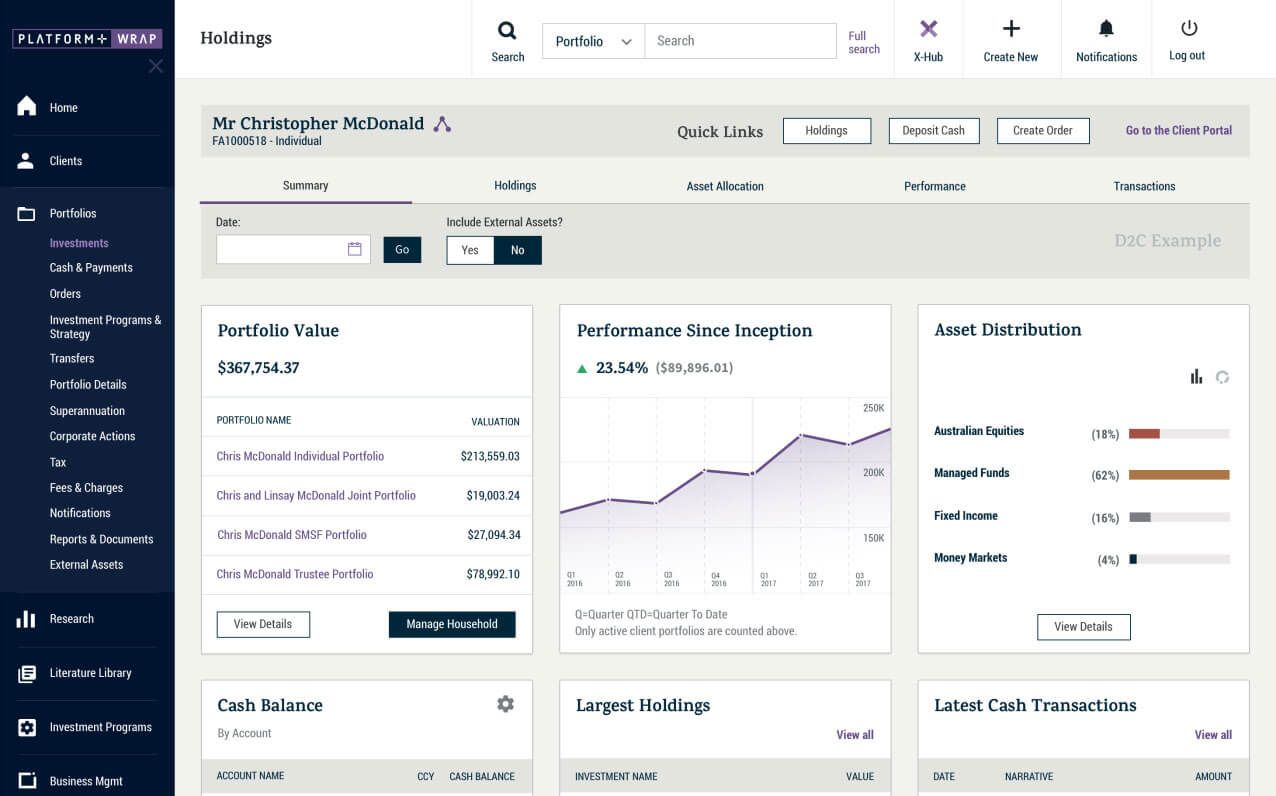

You and your financial adviser can tailor an investment solution to suit your circumstances and retirement goals while taking advantage of the platform’s flexibility as your needs change.

You can establish one or more Portfolios, depending on your current retirement planning needs – and as your needs change, move easily between each portfolio type.

Accumulation

Transition-to-retirement (TTR)

Pension

Our Super solutions have been designed to deliver clear benefits:

We’ve developed a Super platform that provides a flexible, convenient account structure.

You and your adviser can choose between the Core Menu and Select Menu which offer different investment options for you to invest in and build your preferred investment strategy.

You can diversify your investments across a range of investment types, asset classes and investment styles – your adviser will work with you to determine the most appropriate strategy for your needs and values.

| Investment Menu | ||

|---|---|---|

| CORE | SELECT | |

| INVESTMENT TYPE | ||

| Listed Securities | ✓ | |

| Managed Funds | ✓ | ✓ |

| Managed Accounts | ✓ | ✓ |

| ETFs | ✓ |